The trend in offshore wind in the USA is now so strong that the local value chain is having trouble keeping pace. This could constitute an opening for Danish companies with strong offshore competencies, says Liz Burdock, CEO of the Business Network for Offshore Wind. She highlights the Port of Esbjerg as the offshore industry's ”Nirvana” and an excellent role model.

The offshore wind industry on the American East Coast has now gathered so much momentum that the local supply chain is having trouble keeping up with the trend. And if we look just a few years ahead, there is a high risk of a 'competency bubble' resulting from the local lack of necessary offshore competencies. This could delay the offshore wind projects that have already been approved or are awaiting approval.

These are the views of Liz Burdock, CEO of the interest organisation the Business Network for Offshore Wind.

”Bearing in mind the schedules for the projects under way on the East Coast at the moment, it's clear that a competency bubble will develop in about 2021-2022, unless we take action. I'm worried that our own supply chain is not sufficiently robust, and that we will eventually lack companies with the relevant offshore knowledge to quite literally launch these projects," says Liz Burdock.

She therefore believes foreign offshore companies will be needed to help out. Not to out-compete the locals, but to team up with American companies at all levels of the value chain to raise the capacity level.

Liz Burdock is CEO of the interest organisation the Business Network for Offshore Wind.

Convincing business case

Liz Burdock's announcement follows a hectic half year of vying between the eastern states over how many gigawatts of electricity from offshore wind they will undertake to purchase over the next 10-15 years. The energy debate in America is taking a completely different course, as until recently it was impossible to convince politicians that the business case for offshore wind could hold water.

But you can convince them now, says Michael Hannibal. He is a partner at Copenhagen Infrastructure Partners (CIP), which together with a Spanish energy company back in May 2018 won the right to build USA’s first large commercial offshore wind farm, Vineyard Wind.

”I've travelled with offshore wind in the USA for the past ten years and I think it has been vital for the current momentum that the cost curve has decreased. Previously, the Americans had the idea that offshore wind was attractive but out of their financial reach. We have turned that around now,” says Michael Hannibal.

Massachusetts blazed the trail

The new positive winds of change really began to blow when Massachusetts passed a law last August specifying that by 2027, the state's electricity companies must buy 1.6 gigawatts from offshore wind production. This prompted the politicians in the other East Coast states to follow suit as most have realised that if the states and cities are to achieve their declared climate goals of significantly reducing their CO2 footprints, more sustainable energy must be brought into the energy mix. And as there are apparently no suitable areas on land, the Atlantic Ocean is the best option. Another factor is the American investment in developing a brand new industry around offshore wind that in the long term will bring many new jobs, growth and optimism locally.

”The important thing is that the political community is now ready to back its words with money, so it's really poised to become a hot market. We have always known that the USA would come to the offshore wind party in its own good time but also that once it arrived and focused, sparks would fly on the dance floor. And they have,” says Liz Burdock.

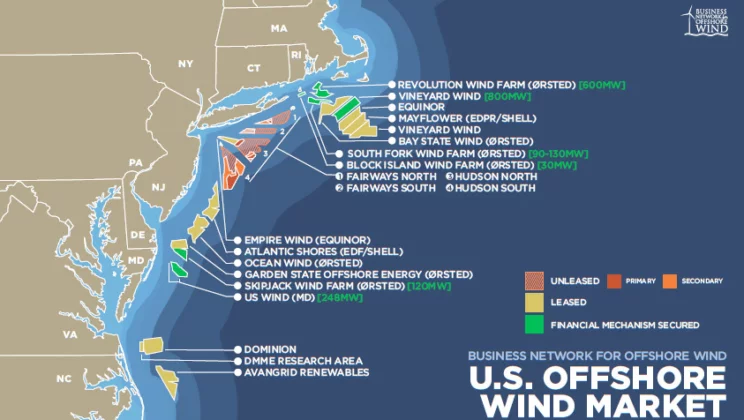

Here is a map showing the planned wind projects on the American east coast.

New markets always put pressure on the value chain

At the industry organisation Vindmølleindustrien, CEO Jan Hylleberg points out that the value chain is always put under pressure when new markets open.

”And when you start on such a grand scale as is the case in the USA, it will always be a challenge,” says Jan Hylleberg.

He sees good opportunities for Danish wind companies, especially those that have already gained experience from working with the American onshore wind industry.

”Danish skills and knowledge have been strongly represented in the American onshore wind market for years, so Danish companies are both well-known and familiar with the American situation and markets. Naturally, they therefore have some opportunities if they can transfer some of that knowledge to the offshore market,” he says.

Only five offshore wind turbines in operation

While the USA is responsible for the world's second-largest onshore wind production, beaten only by China, the country is an absolute novice when it comes to offshore wind. Right now, there are 16 large offshore wind turbine projects under way, from North Carolina in the south to Massachusetts in the north, but only one of them is in operation. That is Block Island Wind Farm, which opened in December 2016 and despite having just 5 wind turbines and producing a modest 30 megawatts is still the USA’s only offshore wind farm in operation.

Since October last year, Block Island has been 100-percent owned by Ørsted. With this purchase, Ørsted consolidated its position as the most active offshore developer on the East Coast. If all goes as planned, according to a review by the Business Network for Offshore Wind, the 16 projects will be able to deliver 21 gigawatts by 2035.

Block Island Wind Farm opened in December 2016. Despite having just 5 wind turbines and producing a modest 30 megawatts it is still the USA’s biggest (and only) offshore wind farm in operation. Photo: Ørsted US Offshore Wind.

Northern Europeans are preferred

One of the offshore wind farms that from about 2021 will be contributing 0.8 gigawatts of green energy a year will be the partly Danish-owned Vineyard Wind. Here, MHI Vestas was chosen as the preferred supplier of wind turbines, and COWI is in charge of large parts of the engineering work.

The owners are also using the model that involves local partners in its wind turbine projects in Asia and Europe. And according to partner Michael Hannibal, experience shows that when they need to find the most highly skilled business partners and sub-suppliers for the local companies, they often end up choosing someone from Northern Europe.

”We are very happy to partner up with local companies, but when we need the best companies and the best engineering capacities and experts on board, we often end up with Danes or Northern Europeans. Northern Europe and not least Denmark are clear world leaders in offshore wind,” says Michael Hannibal

A conveyor belt across the Atlantic

Jan Hylleberg believes that, initially, the low-hanging fruit will be picked by well-known players.

”The most obvious opportunities are within the reach of companies directly supplying offshore construction projects. In other words, foundations, installations, logistics, service and maintenance. The classic part of the offshore value chain that is normally anchored locally offers opportunities for Danish companies right now,” he says.

But in the longer term, even more can open up.

Henrik Stiesdal, former long-term CTO at Siemens Wind Power, and a Danish wind turbine design pioneer, believes Danish wind exports to the USA have good prospects. Because transporting Danish-produced offshore wind turbines across the Atlantic can pay off. According to Stiesdal, the transport costs are relatively low, and the good Danish infrastructure can be used with the Port of Esbjerg at its heart.

”It's easy to imagine a kind of conveyor belt across the Atlantic. It's not science fiction. If a wind turbine factory such as Welcon based in Give, Denmark, can be globally competitive, it's because transport is of no great consequence. The same applies across the Atlantic,” says Henrik Stiesdal, highlighting that it only makes sense to transport wind turbines.

”Of course it's conceivable that new offshore wind turbine factories will be built in the USA but that's very expensive to set up. Instead, it would make sense to send nacelles and wings from Esbjerg directly to the US ports, and ship them from there. And then the towers can be made in the USA,” he says.

The offshore industry's ”Nirvana”

Liz Burdock from the Business Network for Offshore Wind is quick to mention Esbjerg when naming examples of cities and ports around the world that she believes the American offshore industry can learn from.

”Following the Port of Esbjerg's transformation, it is an international offshore hub that we can learn a great deal from. We can't just copy it, but we can take all the excellent experience and adapt it to suit our own situation,” says Liz Burdock.

Since 2013, she has visited the Port of Esbjerg three times, occasionally in the company of state politicians and other stakeholders invited by the network to join the study trips.

”As we see it, the Port of Esbjerg is a kind of ”Nirvana” for offshore that we can show our politicians and say: ’Here is the proof that targeted investments in offshore wind can stimulate growth and optimism in a local community',” says Liz Burdock.

She urges Danish companies, large and small, to check out the opportunities related to entering the American offshore market.

Here, her network can help establish contact with American companies via the organisation's supply-chain database etc. It acts as a register of offshore companies across all the states, making it easy to find the perfect business partner. Local anchoring facilitates understanding the nuances in the market and legislation.

”The value that Danish companies bring to the table is that they actually have experience of working on offshore projects. They have an entirely different specialisation. Therefore, it will be a happy match in many ways if the right partner can be found,” she says.

Go to overview